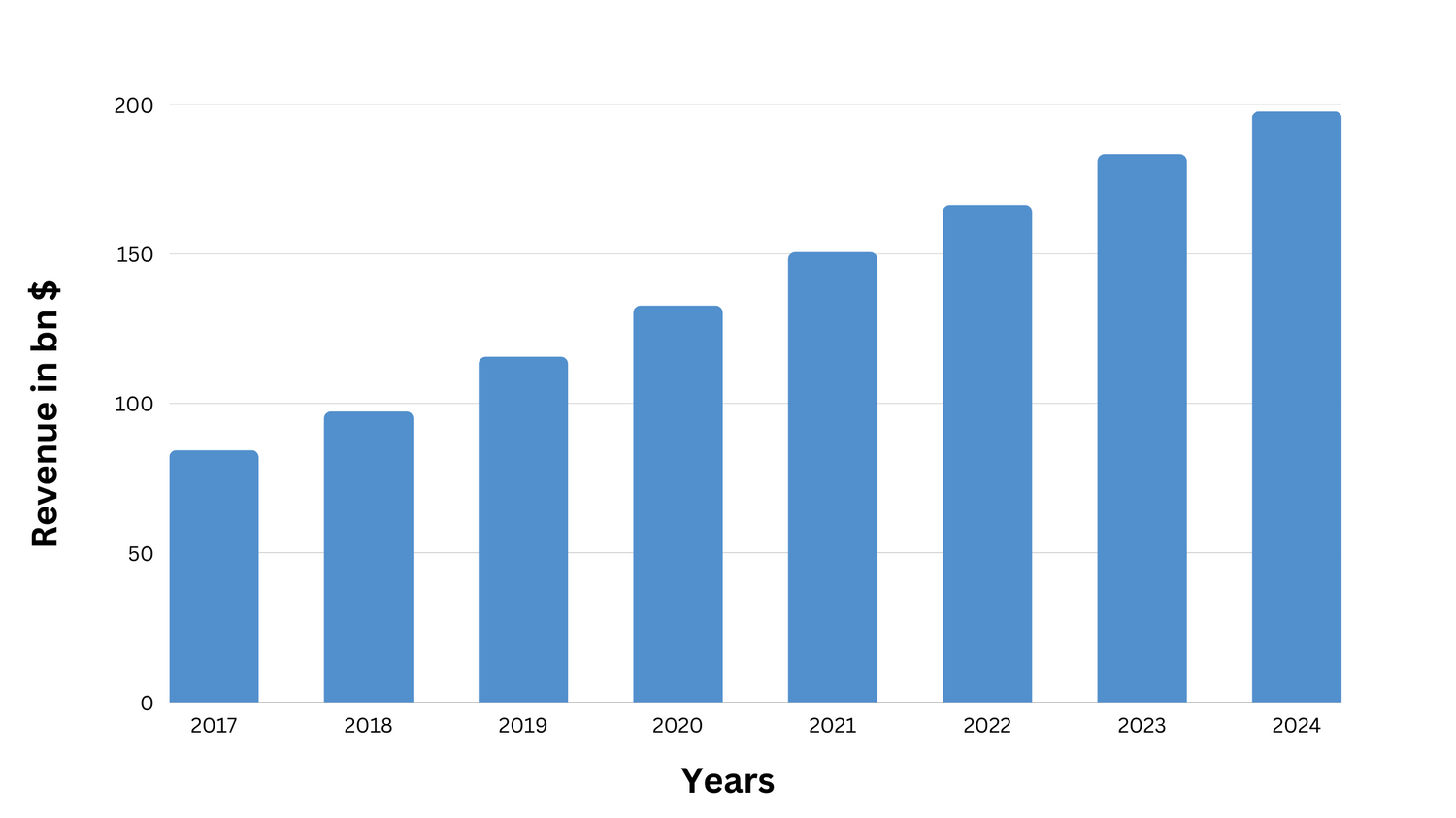

Recent years have seen the popularity of fintech app development, which has gained widespread acceptance across various industries. Including banking, credit, financial investment, and insurance. And consumer finance, with ongoing technological advancements, is decreasing. FinTech app development costs and potential disruption in the financial technology sector are vast. It is estimated that the FinTech market will reach $699.50 billion by 2030. At the same time, digital banking users are expected to grow from 197 million in 2021 to 217 million by 2025. According to Deloitte, the revenue of the global fintech industry has almost doubled since 2017. In 2017, the industry generated around $90.5 billion in revenue; since then, it has grown by more than 100%.

The abundance of statistics points towards the rapidly expanding FinTech app industry. This makes it an opportune time to invest in developing a FinTech app for your business. However, you may be concerned about the cost of building such an app. You need not worry; we have provided a general guide on everything you need to know about FinTech app development costs.

What is Fintech App?

FinTech (short for Financial Technology) apps provide financial services to consumers and businesses, leveraging modern technology such as mobile devices, cloud computing, big data, and artificial intelligence. These apps aim to simplify financial operations, increase access to financial services, and enhance the customer experience. FinTech apps can perform various functions, such as money management, budgeting, payments and transactions, investment and trading, insurance, lending, and many more. Examples of Top FinTech apps include PayPal, Paytm, PhonePe, GooglePay, Mint etc.

The fintech ecosystem offers many solutions that leverage tech to provide innovative financial products and services.

Standard Features of Fintech App

Digital Payments:

Fintech companies offer various solutions for digital payments, including mobile wallets, contactless payments, and peer-to-peer payments. These solutions make it easier and faster for people to transfer money and make purchases without needing physical cash.

Online Lending:

Fintech companies offer various online lending solutions, including peer-to-peer lending, crowdfunding, and online instalment loans. These solutions make it easier and more accessible for people to access credit, particularly for those who may have difficulty getting approved for loans from traditional financial institutions.

Personal Finance Management:

Fintech companies offer various tools and apps for personal finance management, including budgeting, savings, and investment tools. These solutions help individuals manage their finances and make better financial decisions.

Digital Banking:

Fintech companies offer digital banking solutions that enable customers to access financial services online or through mobile apps. These solutions provide more convenience and accessibility for customers who may not have access to traditional brick-and-mortar banks.

Insurance Technology:

Fintech companies offer various solutions for insurance technology, including digital insurance platforms, data analytics, and AI-powered underwriting. These solutions provide more personalized and efficient insurance services to customers.

Blockchain and Cryptocurrency:

Fintech companies are also exploring the possibility of blockchain and cryptocurrency technologies to offer innovative financial solutions, including peer-to-peer transactions, smart contracts, and decentralized finance.

The fintech ecosystem offers solutions that disrupt and transform the traditional financial industry, making financial services more accessible, efficient, and innovative for individuals and businesses.

Types of Fintech App Development

Here are some common types of FinTech apps, each with unique features and functionalities:

Payment and Money Transfer Apps:

These apps allow users to make payments and transfer money securely and quickly, often with low fees.

Personal Finance and Wealth Management Apps:

These apps help users manage their finances, track expenses, create budgets, and invest their money.

Digital Banking Apps:

These apps allow users to access and manage their bank accounts from their mobile devices without visiting a physical bank.

Lending and Crowdfunding Apps:

These apps provide access to loans and allow individuals and businesses to raise funds from many people.

Trading and Investment Apps:

These apps allow users to purchase and sell stocks, bonds, and other financial instruments, often with low fees and no minimum investment requirements.

Insurance Apps:

These apps provide access to insurance products, allowing users to purchase coverage and manage claims through their mobile devices.

Cryptocurrency Apps:

These apps allow users to buy, sell, and store cryptocurrencies, track market prices and manage their digital wallets.

Fintech App Development Cost

We will look at the estimated cost based on its type:

Basic Fintech App:

A basic fintech app is a simple application that performs a few essential functions, such as money transfer or account management. The estimated cost to build a basic fintech app in India can range from INR 5 lakhs to INR 10 lakhs.

Simple Fintech App:

A simple fintech app provides more advanced features like budget tracking or payment reminders. The estimated cost to build a simple fintech app in India can range from INR 10 lakhs to INR 25 lakhs.

Complex Fintech App:

A complex fintech app provides many features and may integrate with multiple third-party services, such as stock market data or lending platforms. The estimated cost to build a complex fintech app in India can range from INR 25 lakhs to INR 1 crore more, depending on the complexity of the app and the features it offers.

These cost estimates are general and can vary based on the specific requirements of the app, the development team’s rates, and the level of expertise needed to build the app. Additionally, ongoing maintenance and updates should be considered part of the overall cost of developing a fintech app.

The Cost of The Best Fintech App Depends on its Type:

The FinTech App Development Cost in India can vary depending on the kind of app and the features it includes. Here are some general estimates of the price of creating different types of fintech apps in India:

Payment App:

A payment app typically allows users to make payments, transfer money, and manage their accounts. The cost to build a payment app in India can range from INR 5 lakhs to INR 20 lakhs, depending on the complexity of the app and the features it offers.

Investment App:

An investment app provides users with tools to manage their portfolios, access real-time market data, and make informed investment decisions. The cost to build an investment app in India can range from INR 10 lakhs to INR 40 lakhs, depending on the complexity of the app and the features it offers.

Lending App:

A lending app allows users to apply for loans, manage their accounts, and make payments. The cost to build a lending app in India can range from INR 15 lakhs to INR 50 lakhs, depending on the complexity of the app and the features it offers.

Personal Finance App:

It helps users manage their finances, track expenses, and create budgets. The cost to build a unique finance app in India can range from INR 5 lakhs to INR 20 lakhs, depending on the complexity of the app and the features it offers.

It is important to note that these calculations are general and may vary based on the specific requirements of the app and the developer’s rates.

Best Fintech App Cost Based on :

Project Discovery:

In this phase, the development team works with the client to identify the project requirements, features, and design. The estimated cost for this phase can range from INR 50,000 to INR 1 lakh.

UI/UX Design:

The development team designs the app’s user interface and user experience in this phase. The estimated cost for this phase can range from INR 1 lakh to INR 2 lakh.

App Development:

In this phase, the development team builds the app, integrates APIs, and performs testing. The estimated cost for this phase can range from INR 3 lakhs to INR 10 lakhs, depending on the complexity of the app and the features it offers.

Quality Assurance:

In this phase, the development team tests the app for bugs, errors, and functionality. The estimated cost for this phase can range from INR 50,000 to INR 1 lakh.

Deployment and Maintenance:

In this phase, the development team deploys the app to the app stores and provides ongoing maintenance and support. The estimated cost for this phase can range from INR 50,000 to INR 1 lakh per month.

The estimated cost to develop a fintech app in India can range from INR 5 lakhs to INR 20 lakhs. More, depending on the specific requirements of the app, the development team’s rates, and the level of expertise needed to build the app. It’s important to note that ongoing maintenance and updates should also be considered part of the overall Fintech App Development Cost.

Some of the Technologies Commonly Used in Fintech Development Include:

Cloud Computing:

It allows for easy and secure storage and processing of large amounts of data, which is crucial for fintech apps that deal with financial information.

Artificial Intelligence (AI):

AI automates financial processes, provides personalized recommendations to users, and detects fraud.

Blockchain:

Blockchain technology provides a secure and transparent method for storing and transmitting financial data, making it useful for applications like cryptocurrency and secure transactions.

Mobile App Development:

With the rise of mobile banking, mobile app development is crucial for fintech companies. Fintech apps are often built for both iOS and Android platforms.

API Integration:

Fintech companies rely on third-party APIs for payment processing, identity verification, and account aggregation.

Cybersecurity:

Fintech apps must be built with solid cybersecurity measures to protect user data and prevent fraud.

Big Data Analytics:

Significant data analytics analyses and understands user behaviour, improve financial decision-making, and detects fraud.

Internet of Things (IoT):

IoT technology is used in fintech for contactless payments, intelligent ATMs, and digital wallets.

The Technology Stacks Commonly Used for Each Type of Fintech App Development are as follows:

Native Mobile Apps:

Native mobile apps are built specifically for a single platform, such as iOS or Android, using platform-specific programming languages like Swift for iOS and Kotlin for Android. They can provide high performance and functionality and access hardware-specific features like biometric sensors. The technology stack for native mobile apps may include cloud-based services. Like AWS or Google Cloud Platform, APIs for payment processing, user authentication, and other fintech services.

Hybrid Mobile Apps:

Hybrid mobile apps are built using web technologies like HTML, CSS, and JavaScript and are packaged in a native wrapper to run on iOS and Android. They can offer a faster development cycle and lower cost than native apps. While providing access to platform-specific features like push notifications. The technology stack for hybrid mobile apps may include web frameworks like React Native or Ionic and APIs for payment processing, user authentication, and other fintech services.

Web Applications:

Web applications can be accessed from any web browser and provide a similar functionality level to native apps. They can be built using various programming languages like Java, Python, or Ruby and front-end frameworks like Angular or React. The technology stack for web applications may also include APIs for payment processing and user authentication. Other fintech services and cloud-based services like AWS or Google Cloud Platform.

Desktop Applications:

Desktop applications are built specifically for desktop operating systems like Windows or MacOS and can provide high performance and functionality. They can be created using various programming languages like Java, C#, or Python and can use front-end frameworks like Electron or Qt. The technology stack for desktop applications may also include APIs for payment processing, user authentication, and other fintech services, as well as cloud-based services like AWS or Google Cloud Platform.

Overall, the technology stack used for fintech app development will depend on the app’s requirements and the fintech company’s goals.

Also, Read ( Process of Mobile App Development )

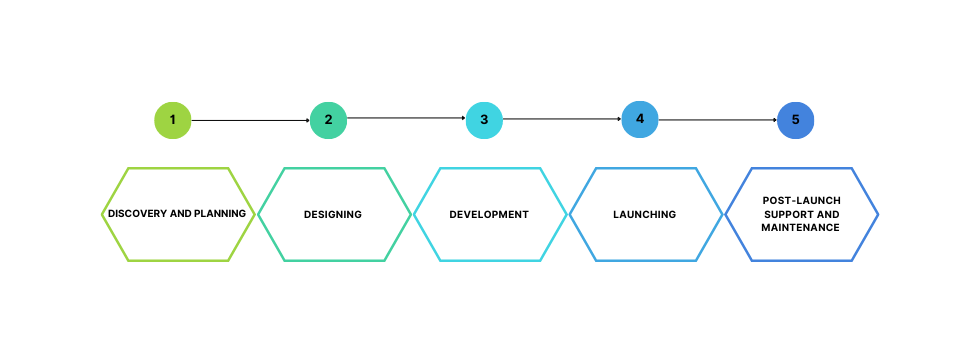

Here are The Typical Stages of Fintech App Development:

- Discovery and planning

- Designing

- Development

- Launching

- Post-launch support and maintenance

Each stage of the development process is critical to the project’s success and should be carefully planned and executed to ensure a high-quality and effective final product.

If You are Searching for The Right Fintech App Development Company:

Choosing the right fintech app development company can ensure you can access your financial solutions’ latest and most effective technologies, trends, features, and functionality. This allows you to manage your business operations efficiently and cost-effectively while staying up-to-date with the latest fintech trends.

Appasteria’s team is highly skilled in using the latest technologies, frameworks, and methodologies to create top-quality web and mobile solutions for our clients. Whether you’re looking to develop a new fintech app or enhance an existing one, we have the expertise to help you reach your goals.

Check out our expertise and see how we can help you take your fintech app to the next level.

FAQs:

What Factors Affect the Cost of Fintech App Development?

The Fintech App Development Cost can be influenced by several factors, including the app’s complexity, the number of features, the development platform, the technology stack, the design, the development team’s experience, and the timeline for the project.

How Much Does it Cost to Develop a Fintech App?

The Fintech App Development Cost can vary widely depending on the above factors. A basic fintech app can cost anywhere from $10,000 to $30,000, while a more complex app with advanced features and custom design can cost upwards of $100,000 or more.

Can I Develop a Fintech App on a Tight Budget?

Yes, developing a fintech app on a tight budget is possible. However, you may need to compromise on certain features and functionality to fit within your budget. Working with a development team that can help you identify the most critical parts of your app and provide cost-effective solutions is essential.

How Long Does it Take to Develop a Fintech App?

The timeline for fintech app development can vary depending on the complexity of the app and the development team’s experience. A basic fintech app can take two to four months to develop, while a more complex app can take up to a year or more.

Can I Update my Fintech App After it’s been Launched?

Yes, you can update your fintech app after it’s been launched. It’s essential to keep your app up-to-date with the latest features and security measures to ensure a positive user experience and maintain user trust. Your development team should provide ongoing support and maintenance to help you keep your app updated and secure.